Access to finance has been identified by various studies as one of the biggest challenges facing small businesses in the Nigerian economy. Many Micro, Small and Medium Enterprises (MSMEs), out of desperation, take loans from informal financial markets and finance companies at outrageous interest rates, sometimes as high as between 50% – 120% per annum.

Worse still, to access such loans, MSMEs are subjected to a lot of complex requirements such as loan collaterals, strenuous documentation, and bureaucratic processes, which impede access to credit by small businesses. Consequently, a lot of people with ideas and who are willing to create jobs and aid the economic development process of the nation are discouraged.

It is against this backdrop that the recent launch of the Constituency Intervention Revolving Loan for MSMEs by the Senator representing Lagos East Senatorial District, Senator Mukhail Adetokunbo Abiru (FCA), was lauded by stakeholders and beneficiaries as a great initiative aimed at economic inclusion and poverty reduction among hapless and helpless Nigerians.

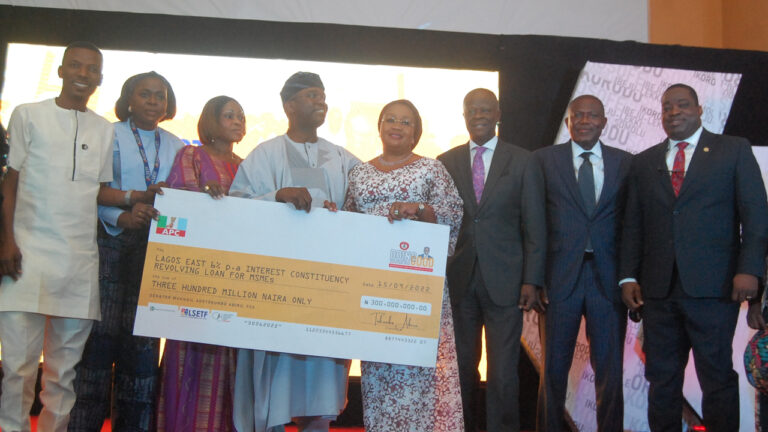

Abiru, who is the Chairman, of the Senate committee on industries recently launched an N300 million Constituency Intervention Revolving Loan at a 6% single-digit interest rate per annum for Micro, Small and Medium Enterprises (MSME) and entrepreneurs in the senatorial district.

A retired bank Chief Executive and former Commissioner for Finance in Lagos State, he told an elated audience at the launch that he was supporting MSMEs in Lagos East because they play a pivotal role in economic development and contribute immensely to the national Gross Domestic Product (GDP).

He said, “Micro, Small and Medium Enterprises (MSMEs) play an important role in the economic development process. This reality is acknowledged globally. They play crucial roles in job creation, income redistribution, mobilisation of small savings, technology adaptation, economic inclusion and many more. In Nigeria, the MSMEs account for about 50 per cent of our GDP and over 80 per cent of employment and have footprints across all sectors of our economy. Therefore, they offer good channels for the realisation of development objectives of job creation, economic inclusion and poverty reduction.”

Abiru said the revolving loan would go a long way in bringing succour to numerous small businesses in the Senatorial district. He disclosed that to ensure the sustainability of the scheme, a risk management framework has been developed to make the scheme impact many more people beyond the first round of beneficiaries. The loan tenor ranges between 3 to 18 months with a limit per beneficiary pegged at between N100, 000 to N1, 000,000.

Some of the beneficiaries of the highly concessional loan were elated and expressed gratitude to Abiru for “providing the much-needed support for their respective businesses.”

The fund size is N300 million at a highly concessional 6 % (All-in) single digit Interest Rate Per annum. The loan tenor is between 3 to 18 months and the limit per beneficiary is pegged at N100, 000 – N1, 000,000.

Abiru was commended by dignitaries present at the launch, including the governor of Lagos State, Babajide Sanwo-Olu, top executives of finance agencies in Nigeria and leaders of the party, for fulfilling the promise he made to the electorate.

Governor Sanwo-Olu, who was represented by his deputy Chief of Staff, Gboyega Soyannwo, said Senator Abiru has continued to keep faith with the people.

“I commend Senator Abiru for keeping faith with his constituents, the good people of Lagos East Senatorial District and the entire people of Lagos State through effective representation and the various empowerment programmes he has initiated, including the one being unveiled here today. This is an example of the dividends of democracy our people desire and we will not relent in ensuring that the welfare and wellbeing of our people remain our one and only priority.”

Chairman of the occasion, Olawale Edun, an international finance expert, who is also the Chairman, the ChapelHillDenham Group, acknowledged that Senator Abiru has brought great value into governance as an accomplished professional.

The former Lagos State Commissioner for Finance said: “If you want to do anything that will be sustainable, do it the way Abiru has done it – bringing major institutions who will train and assist people and empower them to do their business. It is almost free money considering the 6% interest rate per annum. Take this money and use it well so that another person can benefit.”

Managing Director, Bank of Industry, Olukayode Pitan, in his remarks, charged MSMEs to reposition their businesses in line with post-pandemic realities.

He said, “The pandemic taught us many life-changing business lessons. We now know that new business owners’ top priority isn’t only financing but credible business intelligence and knowledge to guide their creation, survival and success strategies. The pandemic required resilient entrepreneurs to adapt their businesses to new economic realities, from making and branding their products to reaching customers.”

Director General, Small and Medium Enterprises Development of Nigeria (SMEDAN), Olawale Fasanya, said he was also a beneficiary of the good deed of Senator Abiru.

“I am not sure the people of Lagos East know the kind of Senator they have. In my 19 years of working at the SMEDAN, I have not seen this kind of Senator. He is very passionate about the wellbeing of his constituents.”

Executive Secretary, Lagos State Employment Trust Fund (LSETF), Tejumola Abisoye, who was represented by Omolara Adewunmi, Director, Programmes, LSETF, said the agency was pleased to partner with the office of the Senator in implementing the laudable initiative. She said 6% Interest per annum, which was subsidised by the Senator, is the lowest MSMEs can get anywhere. “No financial institution can give you that. Even at LSETF, we do 9%,” Adewunmi noted.

On his part, the Chief Executive Officer, The Centre for the Promotion of Private Enterprise (CPPE), Dr Muda Yusuf commended Abiru for promoting the economic wellbeing of his constituents.

He said, “This remarkable initiative by Senator Abiru resonates perfectly with our core mandate as a civil society organisation, which is the promotion of private enterprise. We believe that to salvage this economy and ensure social stability, we must promote the growth of private enterprises, especially small businesses. And we must do this in a manner that is impactful and sustainable. In the light of this, it is the belief of the CPPE that this initiative deserves all the necessary support.”