ArtistGNDphotography

Dear Readers/followers,

Millicom (NASDAQ:TIGO) isn’t the most stable or positive sort of telecommunications company, despite an overall set of relatively convincing assets and advantages in its operating geographies – mostly LATAM and Africa (at least prior – not so much in Africa any longer). This is a very pure emerging market play, and those always come with an outsized amount of risk – as well as potential reward, if things go the “right” way or direction.

While Millicom has the sort of tradition you want – 40 years and more – and the sort of history you may want as well-founded by Jan Stenbeck, head of the Kinnevik AB (OTCPK:KNVKF), wanted a company for voice operation and data distribution in networks using cellular radio – this still comes with a decent amount of risk despite a 60% lower valuation than the last time I wrote about it.

Let’s review Millicom for 2023.

Updating 2023 for Millicom Cellular

I’m not the sort of contributor to steer away from covering or writing about companies simply because they have not gone the way I wanted to expect them to go. I know this is a common thing to do – because after all, who wants to write about a company that’s dropped double-digits repeatedly, despite one’s bullish projections?

Me, I believe this is crucial to the honesty and integrity I seek to have as a contributor and financial analyst. I’m not always going to be right, and only hit “homers” – but when I’m wrong, I try to analyze and qualify it.

Millicom has a great history behind it.

The company was actually one of the three first cellular developments (by license) to be granted a license by the FCC, in Raleigh-Durham, NC. After planning for two years, the company began operations here in 1982. Back then, 92% of the world’s population lacked any sort of phone service. Because of this, Millicom’s business idea became to promote global mobile technology through the use of JV’s with local/strategic partners.

Millicom was among the first companies to set up networks in the UK (the Racal-Millicom JV became Vodafone (VOD), China (through China Telecom Systems), and others. It oversaw Microtel Communications, teaming up with British Aerospace and Pacific Telesis, and later became Orange (ORAN), which in turn was M&A’ed by the new parent company Mannesmann, which later was incorporated into Vodafone. Orange was later sold to France Telecom, which itself was renamed Orange.

So, plenty of history – but what remains of Millicom at this time? Well In 1990, the company changed its name to Millicom International Cellular S.A., and operates under the laws of Luxembourg. Today, the company’s operations are found primarily in the geography of Latin America. This is because the company actually:

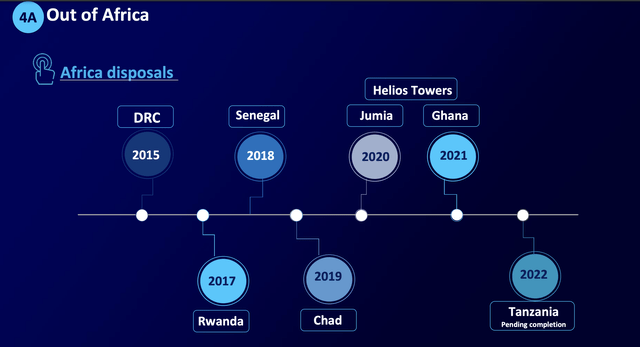

- Left behind its Africa operations, and instead focuses on LATAM.

- Went into cable operations

- M&A’ed/inorganically invested to push its LATAM operations

Whenever a company starts out saying that they’re “staying the course” during a quarterly, you know you’re in for a rocky sort of road – and this is indeed what has been happening.

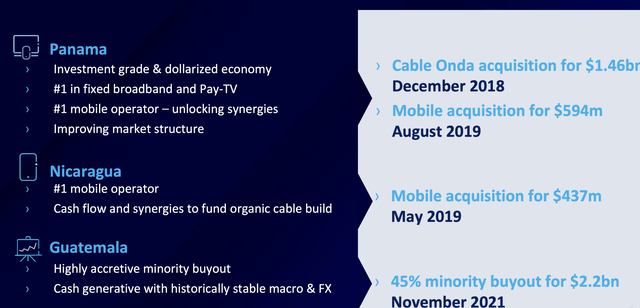

The company is active in very complex, geopolitically unstable positions, such as Panama, Nicaragua, and Guatemala, which it also has been investing in.

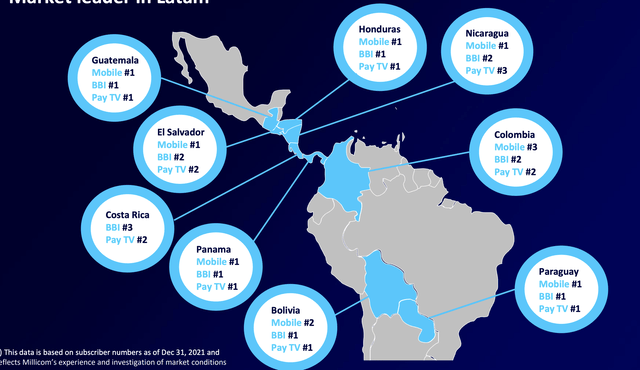

The company’s investments and various projects have left it in a position where we can argue that it’s one of LATAM’s and South Americas largest telecommunications operators – except it’s not active in areas that we typically look at when we look at South American or LATAM operations.

TIGO has nothing in Mexico. It’s not in Chile. It’s nothing in Brazil, Argentina, Venezuela, or similar geographies. Instead, we find TIGO in the following places.

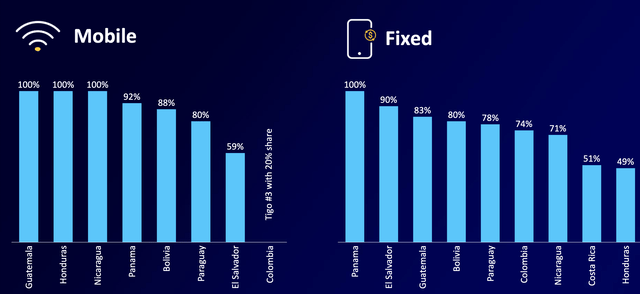

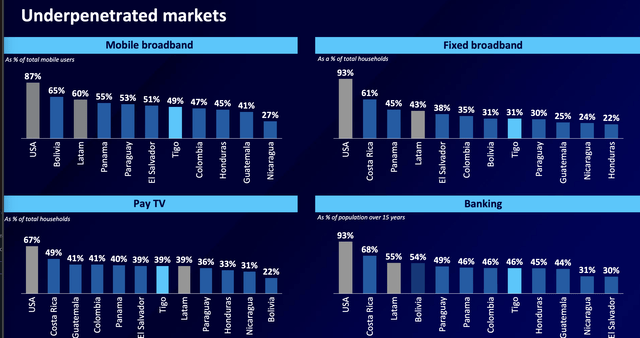

It’s very fair to call TIGO a market leader – just maybe not in nations you’re used to looking at. Now, plenty of people live here, they need communication capabilities, and they have money. If these things converge in the right way, TIGO could be profitable, and its current position not only in mobile, but fixed as well, gives it the opportunity to lead underpenetrated and underdeveloped markets.

This means that if TIGO’s leadership and operations here are successful, investors in TIGO might well look back on this time and view this company as the a-current nascent e-commerce giant, in terms of the returns you might be getting. Because while these nations don’t have the stability that typically characterizes safe investments, they have something that western countries just do not have.

Plenty of population that currently does not have access to or even the possibility of modern communication.

TIGO, because of this, should be viewed as a very long-term play. If the company realizes its ambitions, then its infrastructure and assets over the longer term (10-50) years may well be worth 10-20 times of today’s price – and even that might be conservative, depending on “where” the world moves.

But this is, of course, a very risky proposition, because all we can “currently” see is a company that exposes itself to some of the most volatile markets on earth (though not Africa any longer, which is even “worse” in terms of instability).

The company’s current fundamentals are attractive. Take a look at some of these basics.

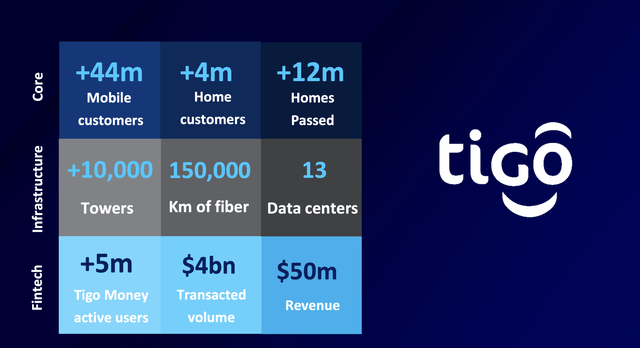

Its revenue split comes 54% from Mobile customer-based communication, 16% from B2B, and 29% from Home. Geographically, it’s by far largest geography is Guatemala, with Colombia and Panama in the second and third place, to a total of $2.5B worth of EBITDA and $5.7B worth of service revenue.

Some of the positives include that many of these nations have dollarized or dollar-linked currencies which are relatively stable, and that much of that revenue comes from subscriptions – also stable – offsetting some of the volatility of what the company might see from these nations here.

TIGO has been on a transformational journey for years. The next few goals the company has is upsizing its Cable – CapEx – winning more in Colombia, cementing its leadership, trying to unlock the value of infrastructure and Fintech, due to the extreme interpenetration of banking, and being able to deliver accelerated OCF growth.

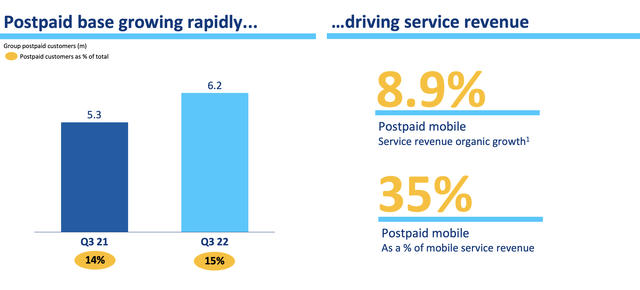

On the whole of it, this is not going terribly. 3Q22 is the latest set of results we have, and the company was able to report 2.7% organic growth in revenue, and 4.5% in OCF, despite the slower macro. This is higher than its established, western peers – most of them at least. The company is currently hitting most of its ambitions, including a low-dingle or mid-single digit B2B/B2C service revenue growth.

Its postpaid base is growing – meaning people are switching from legacy prepaid services, and are opening up to subs. It’s still only at 35%, but it’s growing.

Sports is a big way of getting into these markets given the popularity of football and leagues like Promerica – and TIGO is taking full advantage of this.

By and large, the company’s quarterly results weren’t bad at all. Numbers are growing in almost all geographies, and the company is slowly working towards leadership and expansion. At the same time, it’s far behind in terms of its CapEx spend – and this is part of what’s putting pressure on the share price. The company is still at a 17-18.5% CapEx in terms of sales revenue. This is above almost any western counterpart – and its likely to remain this high for some time.

Combine this with the interest rate environment we’re in, and you can start to understand why things aren’t viewed as positively as they might be in different environments.

Still, TIGO Can monetize and work with some of the assets it has – like the Towers and infrastructure, and its fintech, like TigoMoney, with recent launches in Honduras, nano-lending platforms in the pipeline, and new merchants coming online.

The company is a very early player (comparatively) in driving things we consider to be self-evident, to countries where they are not.

If done correctly, this is not just profitable – it’s explosively profitable. However, we’re entering a macro that is less conducive to such changes, which is the reason (in part) that the company is seeing problems.

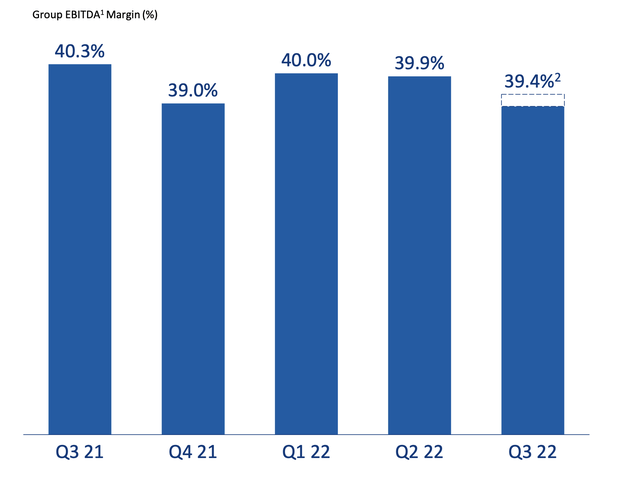

With inflation increases and GDP growth slowing down, these countries are likely to see some hits as well. Group EBITDA is slightly negative YoY for 3Q22 due to energy headwinds, wage inflation, costs, commissions, and investments.

However, TIGO still boasts market-beating margins for a telco company.

The only place we find near-40% EBITDA margins in the legacy western telco sector is home markets for incumbent players – like France for Orange or Spain for Telefonica (TEF).

Aside from that, doesn’t really exist. The company also has lowered debt down to 3x, and has a well-laddered debt profile, with 82% fixed at a nearly 6-year average maturity. The Average cost of debt at 6% might cause you apoplexy, but remember that these are emerging markets – returns and costs are higher.

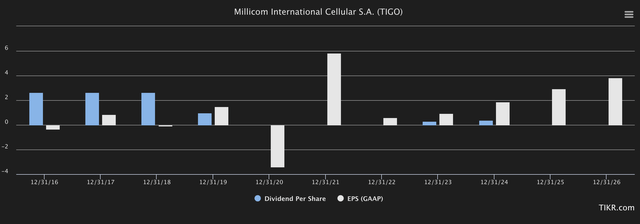

The company has cut its dividend as part of its ambition to improve earnings and cash flows and grow the business. Given the instability of the company, I’m not opposed to this, but it does mean that I consider it a growth-type sort of investment, which I very rarely do.

Now, let’s come to the reason why I’m writing about the company at this particular time – the valuation.

Millicom – The valuation is appealing if you believe in growth

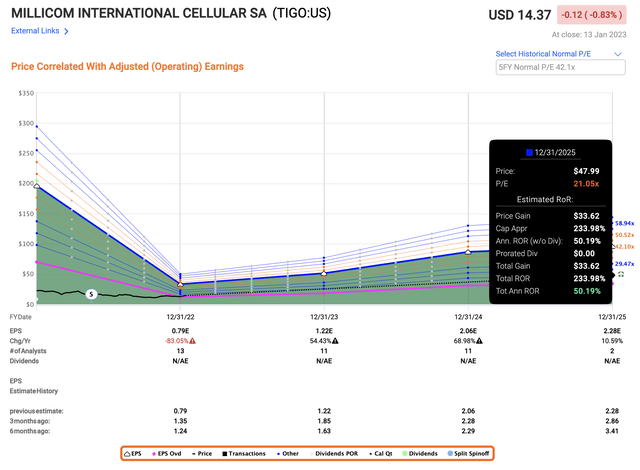

So – Millicom is expected to have troughed, and to grow from here. And by grow, I mean grow by a lot.

Excluding 2022, which is expected to see an adjusted EPS trough, results are then expected to bounce back up by 50-70% per year in 2023 and 2024, followed by more double-digit growth.

The company is in fact expected to put dividends back on the table in 2023 already.

And the current valuation, all things being equal and forecasts being even close to indicative, implies a triple-digit 2-3 year RoR.

This upside can be further supplemented by analysts following the company. After the decline in the company’s valuation, the 6 analysts following the company now consider the upside to be no less than 44.4% here. The PTs range from $14 all the way to $30, with an average level of $21, implying a high upside. Even if forecast accuracy is bad – and it is – there is an undeniable long-term appeal to the company if things do normalize and when these assets are used in the “right” way.

Still, in order to invest in Millicom, you need to be able to stomach the risk that the investment brings with it. As it stands, and for the time being, that’s not something that even I am willing to do.

For very risk-tolerant investors, this one is a “BUY”. The company’s upside is in the triple digits in the long term. For the more risk-conservative, such as myself, there simply are better alternatives that can be invested in that do not suffer from the same sort of risks or challenges that TIGO does. There are telcos like Telefonica that come with emerging market exposure, but also legacy and solid yield to add to the appeal.

For the time being, I consider this to be the better choice.

So while I am at a “BUY” here, I would carefully warn any investor that does not have the stomach for what is essentially a growth telco stock.

Here is my current thesis for TIGO.

Thesis

- Millicom Cellular is a company in the telecommunications business that is the equivalent of a growth stock in this sector. The company has emerging market exposure in LATAM, and with the right set of circumstances, could triple within 5 years, or ten-fold in 10-15 if things go the way the company expects.

- However, the risk/reward ratio is massive here compared to what’s otherwise available on the market and what qualities telcos are known for. So while based on valuation, I view this company as buyable, I would be extremely cautious unless you’re anything but very risk-tolerant.

- Nonetheless, I give TIGO a conservative PT of $18/share, and consider it a “BUY” at this time.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

I view the company as qualitative and cheap – the only problem is the dividend and risk – and those are big ones. It’s also a stretch to call it conservative, but I do believe the underlying assets are “safe”.