Nailing technology predictions in 2022 was tricky business, especially if you were projecting the performance of markets, identifying initial public offering prospects and making binary forecasts on data, artificial intelligence and the macro spending climate — along with other related topics in enterprise tech. 2022 was characterized by a seesaw economy where central banks were restructuring their balance sheets, the war in Ukraine fueled inflation, supply chains were a mess and the unintended consequences of digital acceleration are still being sorted.

In this Breaking Analysis, we continue our annual tradition of openly grading our previous year’s enterprise tech predictions. You may or may not agree with our self-grading system, but we give you the data to draw your own conclusions.

Prediction No. 1: Overall tech spending: C+

As we exited 2021, chief information officers were optimistic about their digital transformation plans. They’d rushed to make changes to their businesses and were eager to sharpen their focus and continue to iterate on digital business models. As such, we predicted an 8% rise in enterprise tech spending, which was looking pretty good until Ukraine, and the Fed decided it had to make up for lost time. We nailed the momentum in the energy sector, but we can’t give ourselves too much credit for that layup.

As of October, Gartner had information technology spending growing at just over 5% this year, so we’ll take the C+ and move on.

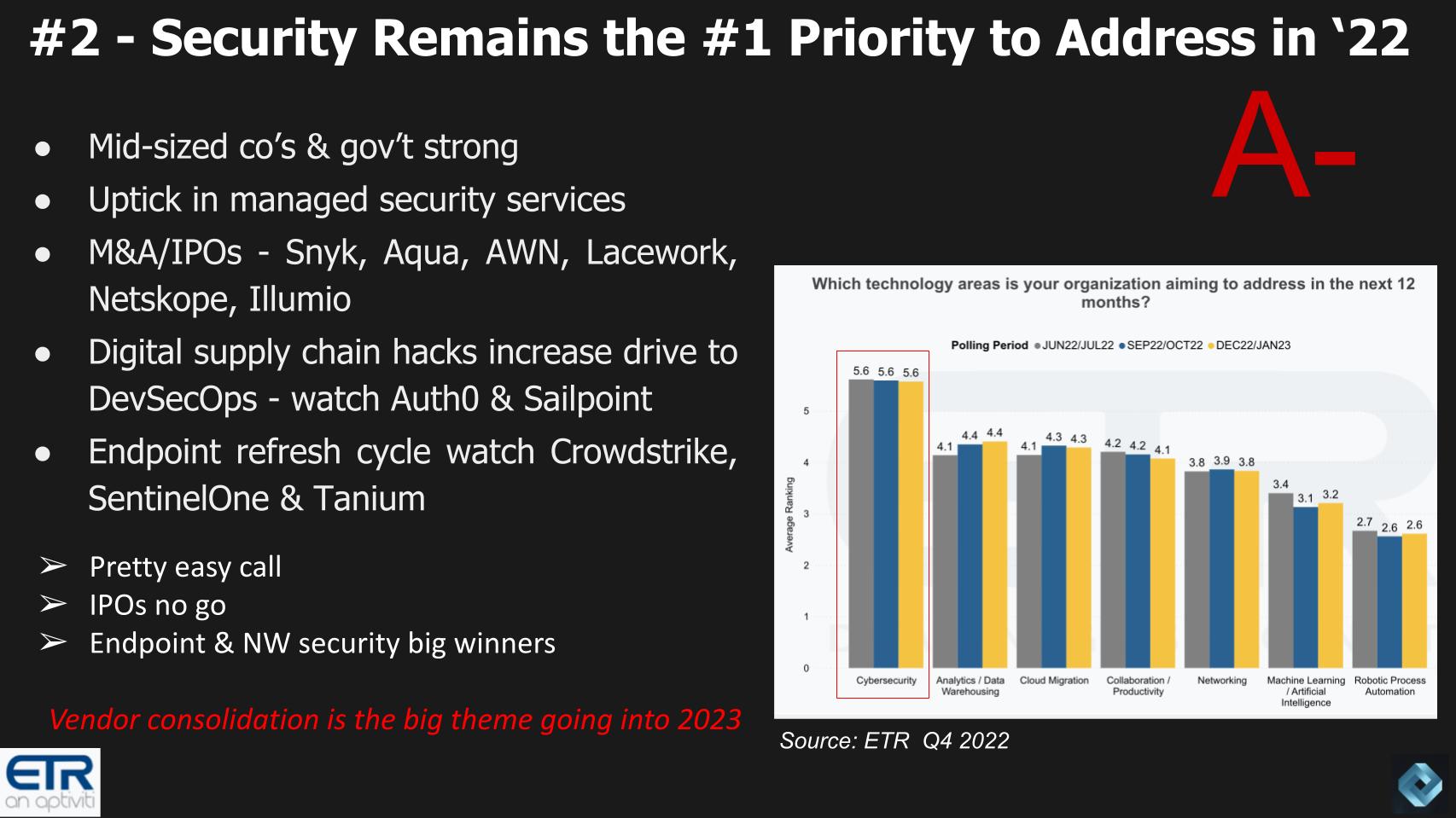

Prediction No. 2: IT priorities: A-

Our next prediction was basically a ground ball to second base, but we felt it was important to highlight that security would remain front and center as the No. 1 priority for organizations in 2022. But we threw in some other predictions to make it harder.

As is our tradition, we try to up the degree of difficulty by specifically identifying companies that will benefit from the trends. And we highlighted some possible IPO candidates, which of course didn’t pan out. Snyk Ltd. was on our radar. The company had to do another raise recently and took a valuation hit, raising $196 million in a down round. Aqua Security Software Ltd.’s focus on containers and cloud native was a trendy call. We thought perhaps an managed security service provider generally or Arctic Wolf Networks Inc. specifically would go public, but no way that was happening in this poor market. Nonetheless we think these types of companies are still faring well as the talent shortage in security remains acute.

Lacework Inc. laid off 20% of its workforce in 2022 and co-Chief Executive Dave Hatfield left the company. Meanwhile, Netskope Inc. remains strong in the ETR Emerging Technologies Survey, with Ilumio Inc. holding its own.

We never liked the $7 billion price tag that Okta Inc. paid for Auth0 Inc., but we loved the total available market expansion strategy to target developers. But we have to take some points off for the failure thus far of Okta to really nail the integration of Auth0 into the company.

The focus on endpoint security was a winner in 2022 as CrowdStrike Holdings Inc. led that charge, with others holding their own… not the least of which was Palo Alto Networks Inc., as it continued to expand beyond network security, and CyberArk Software Ltd.

Overall we’ll give ourselves an A- for this call. We’re closely watching the vendor consolidation trend in 2023. According to a recent Palo Alto Networks survey of 1,300 SecOps pros, on average, organizations have more than 30 tools to manage, and reducing those is a logical way to optimize costs.

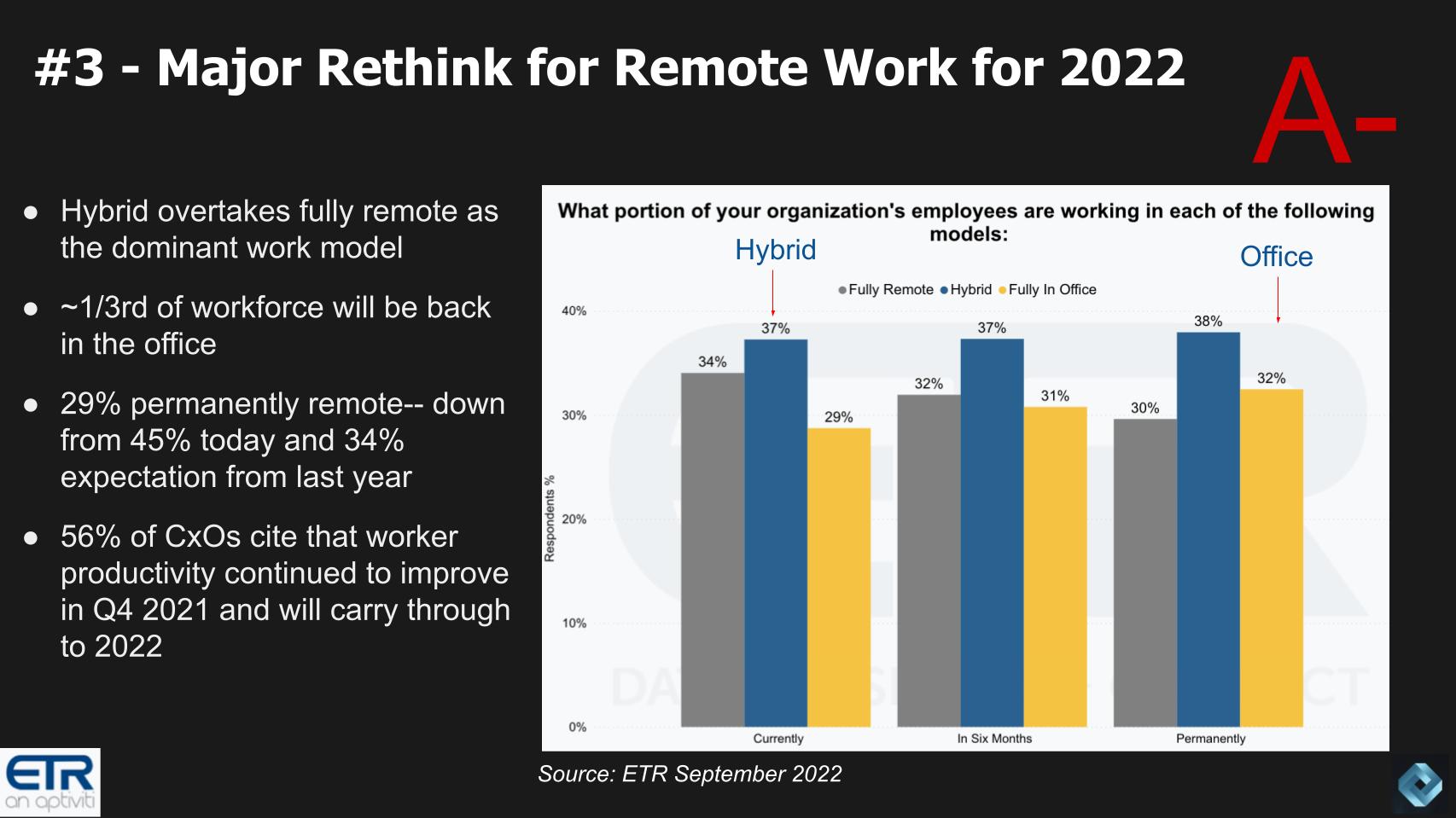

Prediction No. 3: Hybrid work: A-

The big theme of 2020 and 2021 was remote work, hybrid work, new ways to work with an eye toward what the return to work would look like.

We predicted that in 2022, hybrid work models would become the dominant protocol, which clearly is the case. We predicted that about 33% of the workforce would come back to the office in 2022. In September, the Enterprise Technology Research data showed that figure was at 29% but organizations expected that 32% would be back to the office by year-end. That hasn’t quite happened yet, but we were pretty close with those projections. So we’ll take an A minus on this one.

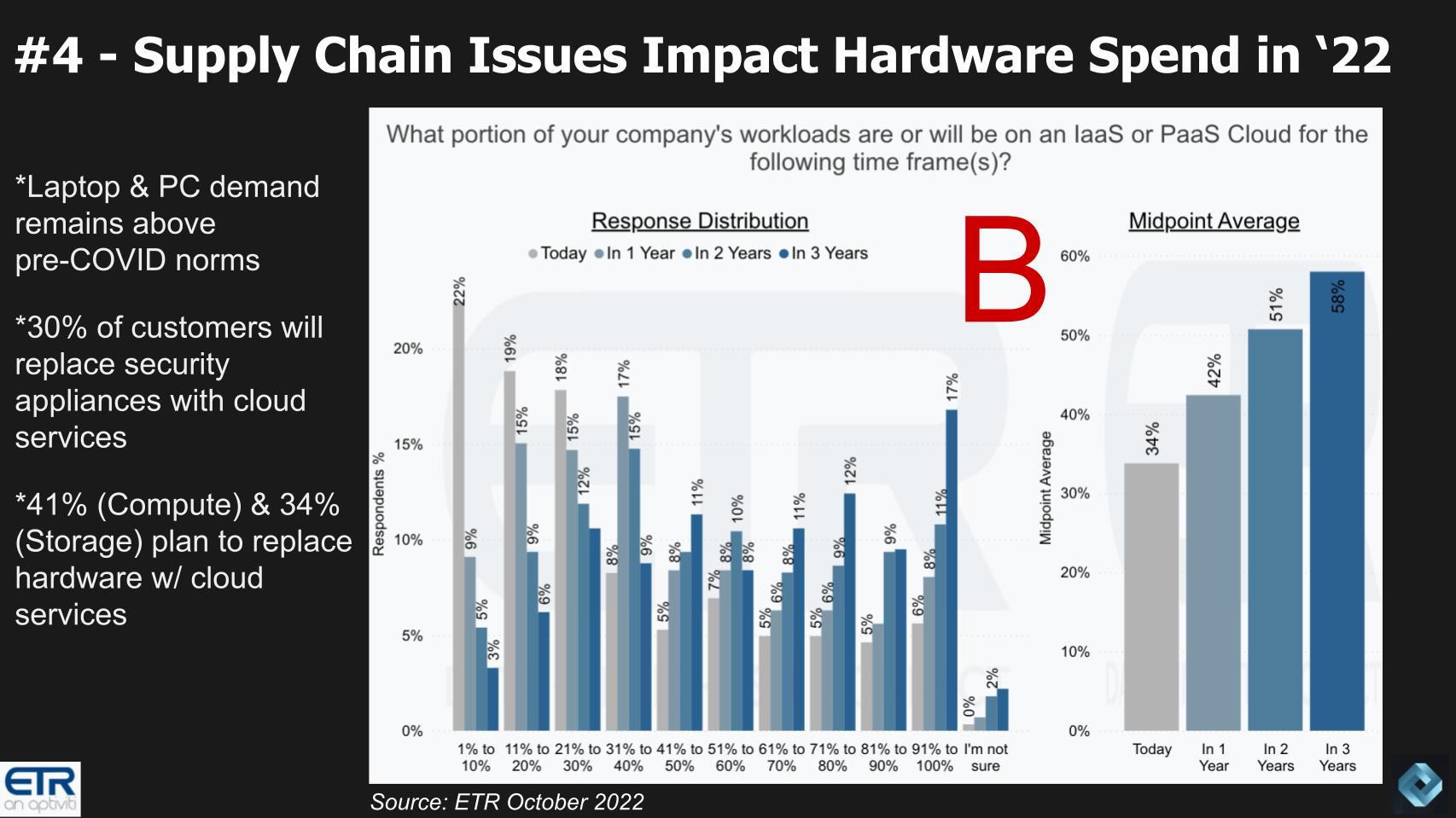

Prediction #4: Supply chain impacts on spending: B

Supply chain disruption was another big theme we felt would carry through to 2022. Sure, that sounds like another easy one, but as is our pattern, we try to put some binary metrics around specific predictions to put some measurability on the trend.

We said PC/laptop demand would remain above pre-COVID levels, reversing a decade of year-on-year declines. Although demand is down this year relative to 2021, IDC has worldwide unit shipments for PCs at just over 300 million for 2022. Go back to 2019 and you were looking at around 260 million units or so.

Why only a B you ask? Well we projected that 30% of customers would replace security appliances with cloud-based services and that more than a third would replace their internal data center server and storage hardware with cloud services.

We don’t have explicit survey data on exactly these metrics, but anecdotally we see this happening in earnest. And we do have some data that we show above on cloud adoption from ETR’s October 2022 survey, where the midpoint of workloads running in the cloud is 34% and forecast to grow steadily over the next three years.

While not a one-to-one correlation with our prediction, it’s a pretty good bet that we were right. But we’ll take some points off for lack of unequivocal proof. We always strive to make our predictions in ways that they can be measured as accurate or not. And we try to provide data as proof. In this case it’s a little fuzzy although we’re pretty comfortable the prediction was accurate.

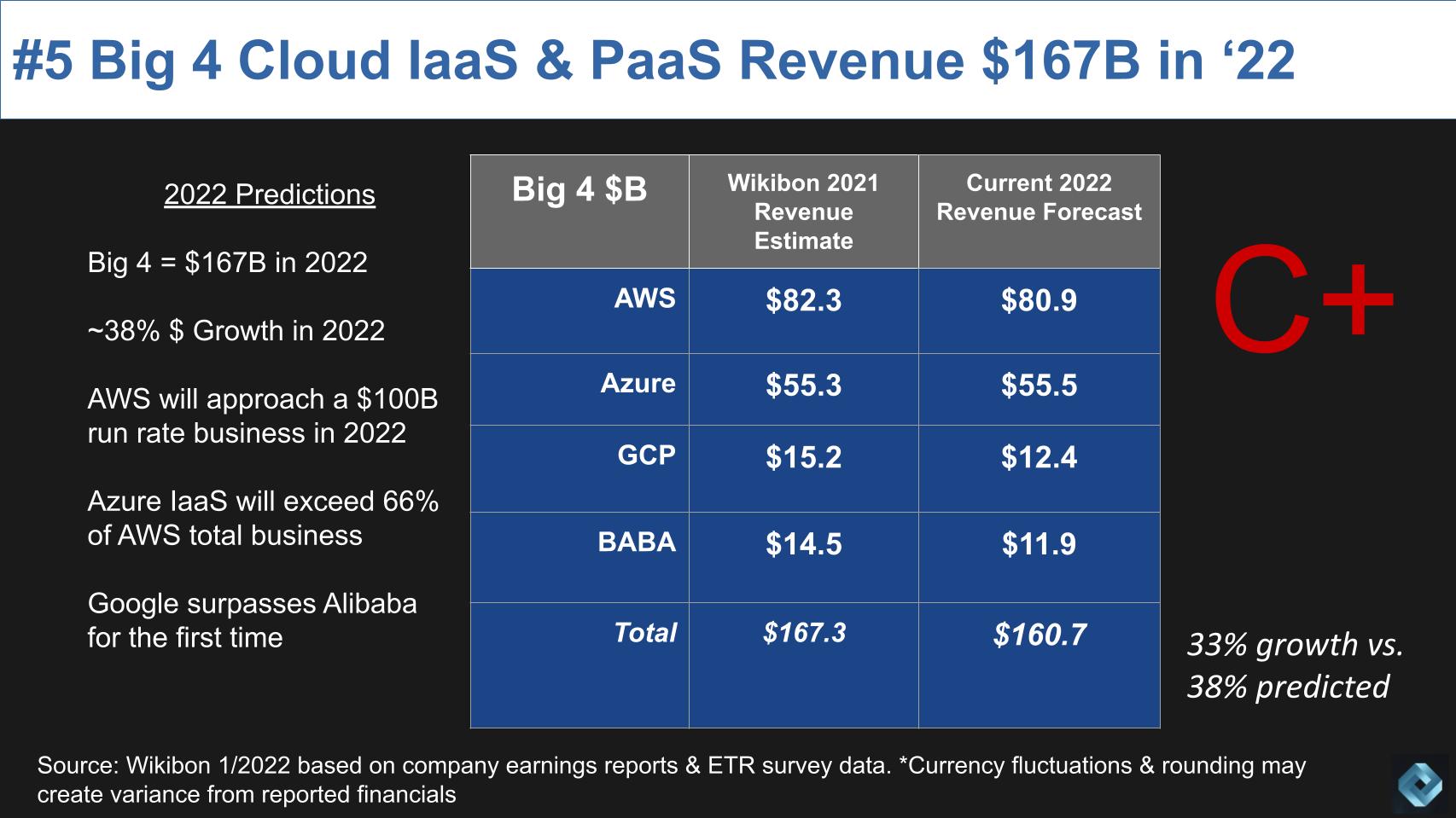

Prediction No. 5: Hyperscale cloud spend: C+

We said that in 2022, the Big Four cloud players would generate $167 billion in instrastructure-as-a-service and platform-as-a-service revenue, combining for a 38% market growth. Our current forecasts are shown here with a comparison to our January 2022 figures and we expect now about $162 billion and a 33% growth rate. Still very healthy, but not on the mark.

We think Amazon Web Services Inc. will miss our predictions by about $1 billion. As well, it won’t hit our overly aggressive expectation of exiting 2022 at nearly $25 billion per quarter. We pretty much nailed Microsoft Azure. But even though our prediction was correct that Google Cloud Platform would surpass Alibaba Cloud, we overestimated the performance of both companies.

We’ll give ourselves a C+ here. Maybe that’s a bit harsh, we could argue for a B-, but the misses on GCP and Alibaba warrant a penalty.

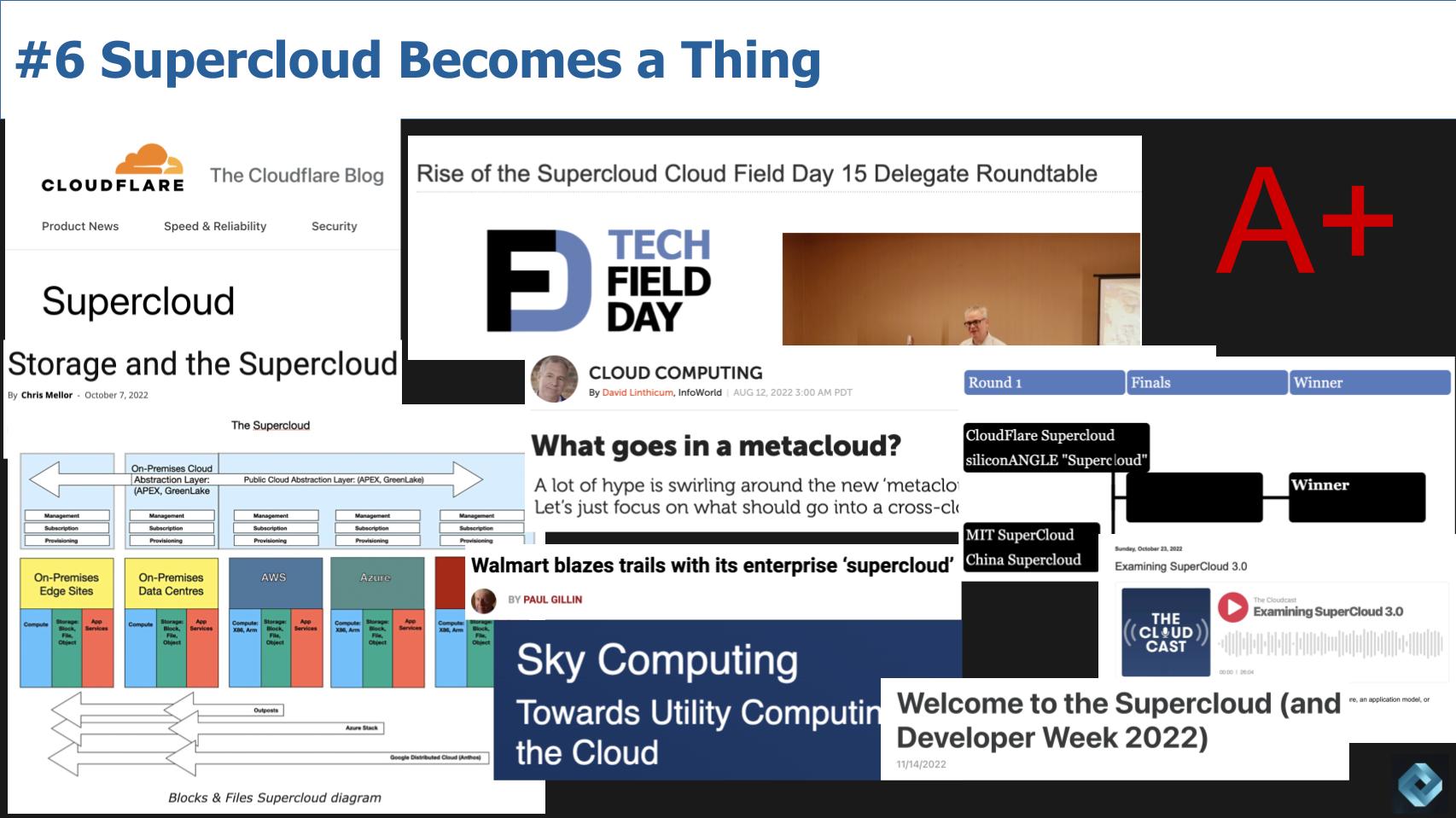

Prediction No. 6: Supercloud: A

Next we move on to our prediction about supercloud. We said it becomes a thing in 2022 and it has. Despite the naysayers, we’re seeing clear evidence that the concept of a layer of value add that sits above and across clouds is taking shape. On the slide below we show just some of the pickup in the industry.

One of the most interesting is Cloudflare Inc.. The biggest supercloud antagonist, Charles Fitzgerald, once predicted no vendor would ever use the term in its marketing. Cloudflare has and it launched its version of supercloud at its Developer Week.

Chris Mellor of The Register put out a supercloud block diagram. David Linthicum uses the term metacloud and supercloud practically interchangeably to describe the trend. Brian Gracely has covered the concept on the popular Cloudcast podcast. The University of California at Berkeley launched the Sky Computing initiative with many concepts highlighted in the supercloud 3.0 community definition. Walmart Inc. launched a platform with many of the supercloud’s salient attributes — as did Goldman Sachs Group Inc., Capital One Financial Corp. and Nasdaq Inc.

You can hate the term, but very clearly the evidence is gathering.

We’ll take an A on this one… sorry, haters.

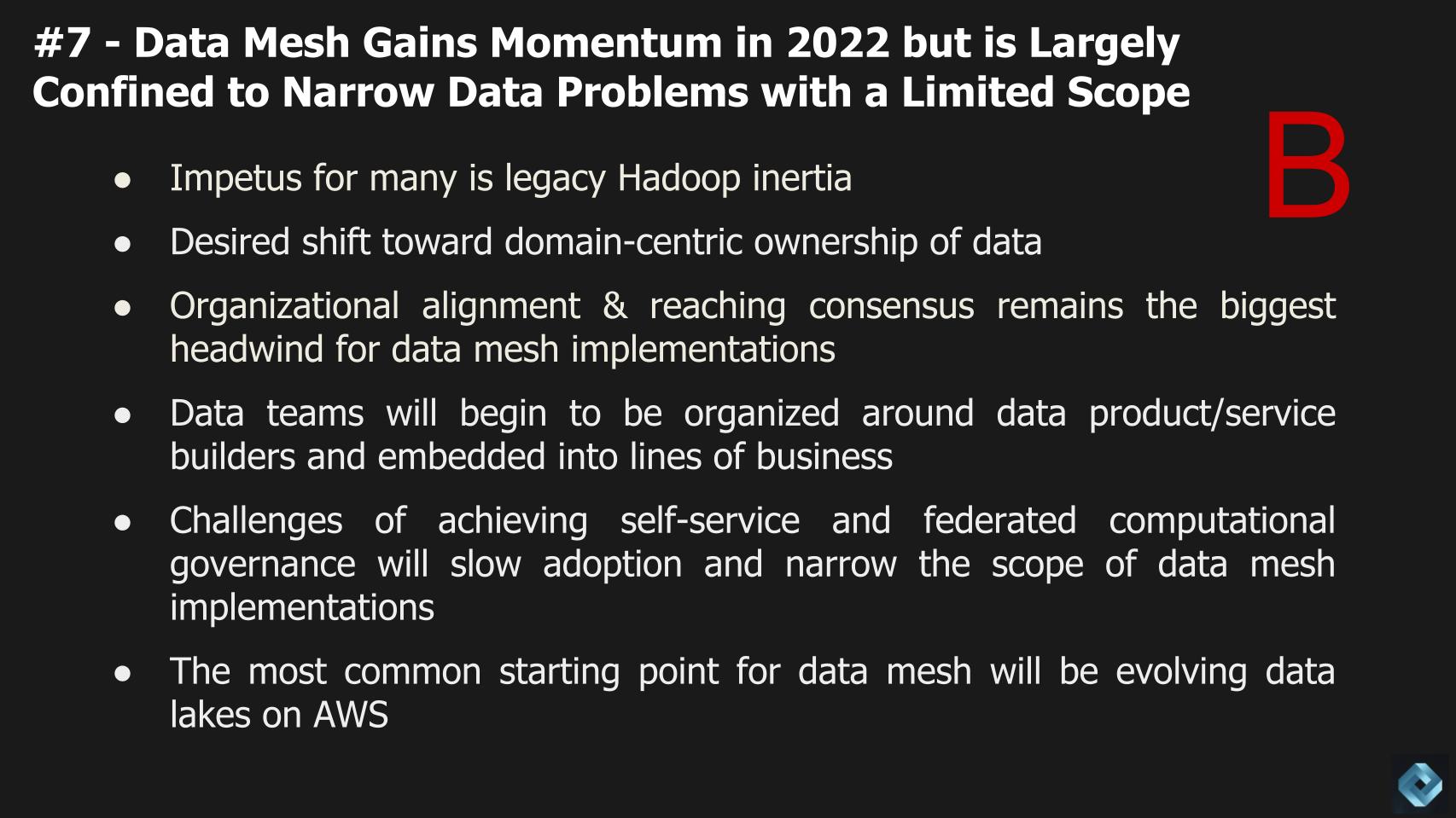

Prediction No. 7: Data mesh: B

Let’s talk about data mesh. In our 2021 predictions post we said that in the 2020s, 75% of large organizations will re-architect their big data platforms. And because it was a longer-term prediction we took an incomplete for a grade.

There’s much discussion in the data community about data mesh. And although there are an increasing number of examples – JP Morgan Chase & Co., Intuit Inc., HSBC Holdings PLC, HelloFresh SE and others, completely re-architecting data platforms is nontrivial. There are organizational challenges, data ownership debates and technical considerations. In particular, two of the four fundamental data mesh principles describe self-service infrastructure and federated computational governance capabilities.

Democratizing data and facilitating data sharing creates conflicts with regulatory requirements around data privacy. As such, many organizations are being selective with their data mesh implementations and hence our prediction of narrowing the scope of data mesh initiatives.

JP Morgan Chase is a good example of this, where a single group is narrowly implementing the data mesh architecture in AWS using data lakes, Amazon Glue and a variety of other techniques to meet its objectives. Many other companies are facing limitations with their Hadoop data platforms and need new thinking. HelloFresh is a good example of this.

The bottom line is that organizations want to get more value from data and having centralized, super-specialized teams that own the data problem has been a barrier to success. Data mesh starts with organizational considerations as described by Ash Naseer of Warner Bros. Discovery Inc. Here’s how he describes it:

When people think of Warner Bros., you always think of the movie studio, but we’re more than that. I mean, you think of HBO, you think of TNT, you think of CNN, we have 30-plus brands in our portfolio and each has their own needs. So the idea of a data mesh really helps us because what we can do is we can federate access across the company so that CNN can work at their own pace when there’s election season, they can ingest their own data and they don’t have to bump up against as an example, HBO, if “Game of Thrones” is going on.

It often is the case that data mesh is in the eyes of the implementer. Although a company’s implementation may not strictly adhere to Zhamak Dehghani’s vision of a data mesh, that’s OK. The goal is to use data more effectively and, despite Gartner’s attempts to deposition data mesh in favor of the somewhat confusing data fabric concept that it stole from NetApp Inc., data mesh is taking hold in organizations globally.

So we’ll take a B on this one. The prediction is shaping up the way we’ve envisioned, but as we’ve previously reported it’s going to take time – the better part of a decade, in our view. New standards must emerge to make this vision come true and they’ll come in the form of both open and de facto approaches.

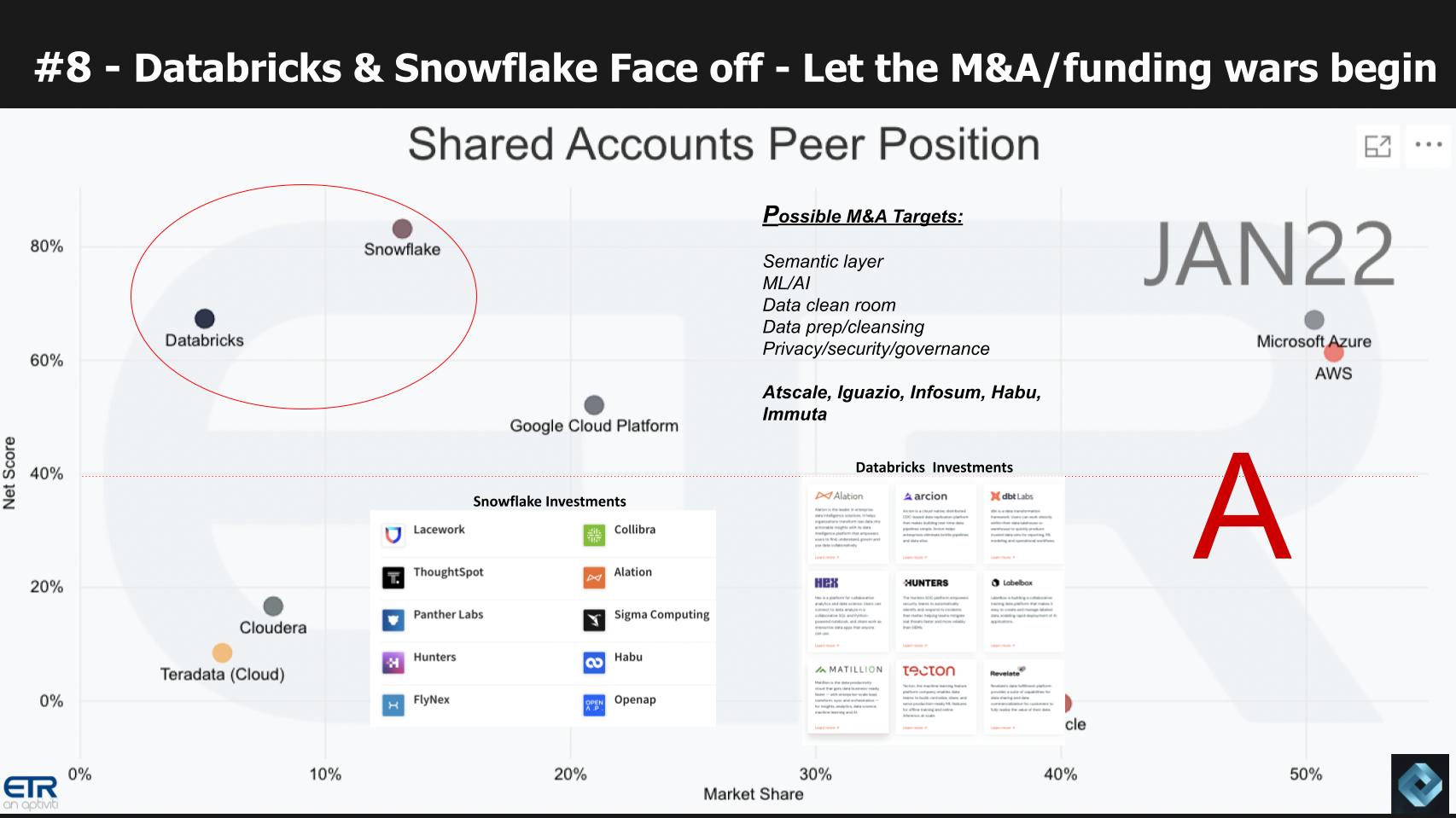

Prediction No. 8: Snowflake versus Databricks: A

Our eighth prediction last year focused on the face off between Snowflake Inc. and Databricks Inc. We realize it’s a popular topic and maybe one that’s getting overplayed, but these are two companies that initially were shaping up as partners. They still are partnering in the field. The idea of using AWS infrastructure, Databricks machine intelligence technology and Snowflake as a facile data warehouse is still viable. But both of these companies have larger ambitions, big total markets to chase and large valuations to justify.

As we’ve previously reported, each of these companies is moving toward the other firm’s domain. And they’re each building out an ecosystem that will be critical to their futures. As part of that effort, we said, each is going to become aggressive investors in and acquirers of companies. And on this chart produced last year, we cited some companies that were targets and we’ve now added the recent investments of Snowflake and Databricks that you can see above.

Both companies have invested in Alation Inc.. Snowflake has put money into Lacework, the security firm, in addition to ThoughtSpot Inc, which is trying to democratize data with AI, and Collibra NV as a governance platform. You can see Databricks investments in data transformation with dbtLabs Inc. Matillion Ltd. doing simplified business intelligence, Cyber Hunters Ltd. in security and so forth.

Other than our thought that we’d see Databricks go public, this prediction has been spot on and we’ll give this one an A.

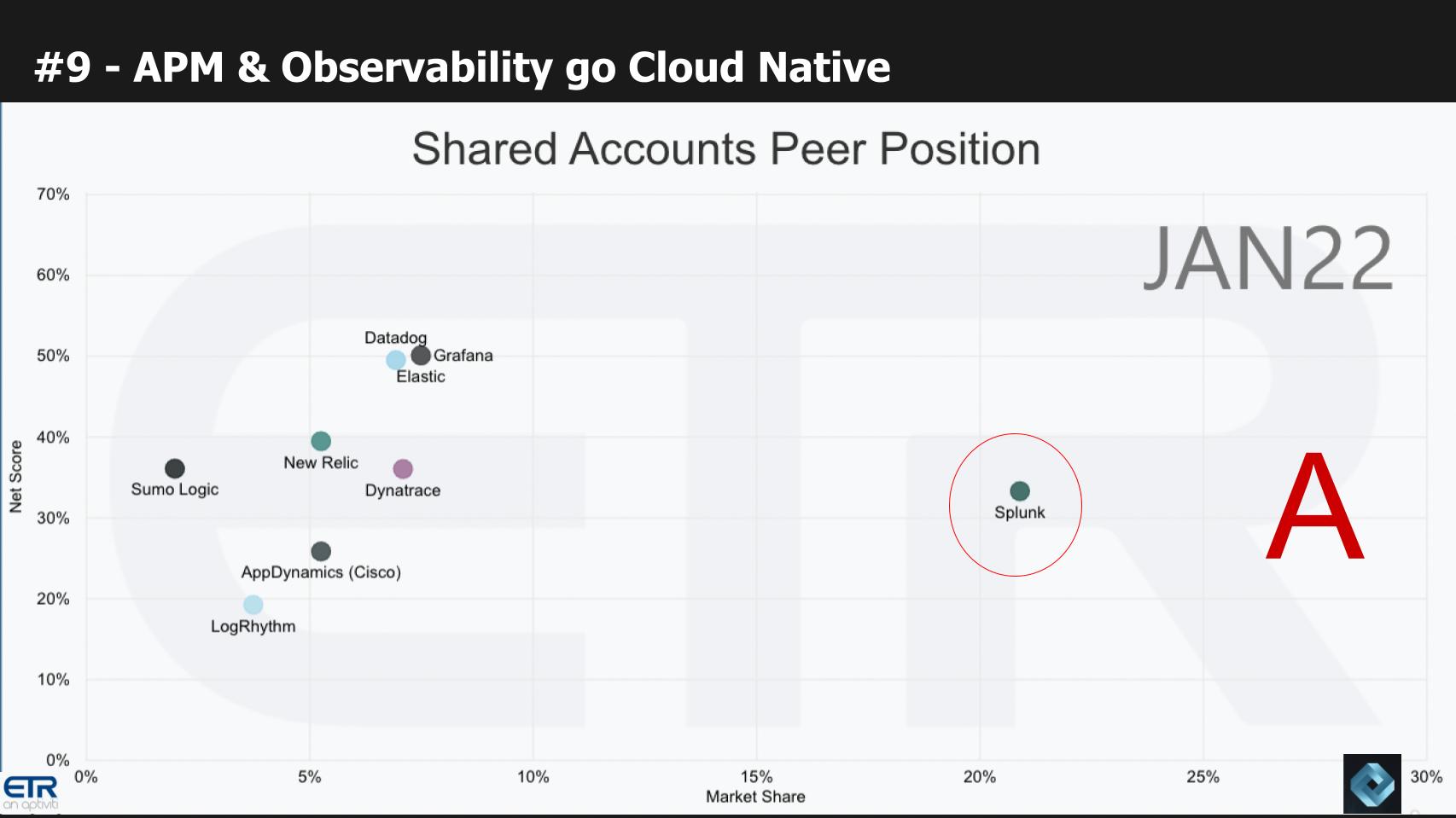

Prediction No. 9: Observability and the cloud: A

Application performance management is evolving toward observability, which has been a hot topic we’ve been covering for a while with our friend Erik Bradley over at ETR. Our No. 9 prediction last year was basically if you’re not cloud-native in this market, you’re going to be in trouble.

And that has clearly been the case. Splunk Inc., the big player in the market, has been transitioning to the cloud. Datadog Inc. has real momentum, the Elastic and the Elk Stack with its open-source cloud model… new entrants that we cited such as Observe Inc., Honeycomb.io, ChaosSearch Inc. and others we’ve reported on are all born in the cloud. So we’ll take another A on this one. Admittedly a pretty easy call, but you need a few of those in the mix.

Prediction No. 10: Hybrid events: B+

The last prediction was around events… something theCUBE knows a bit about. We said the new category of events would be hybrid and for the most part that has happened. But there are still challenges and more learnings to apply.

The narrative behind this is virtual-only events are good for quick hits but lousy replacements for in-person shows. That said, organizations of all shapes and sizes learned how to create better virtual content to serve remote audiences.

We said pure play virtual gives way to hybrid, that the physical defines the experience and there would be VIP events that create fear of missing out and a virtual component that serves an audience 10 times the size of physical. Even examples of our prediction of metaverse-like immersion have popped up and many companies are back to doing regional roadshows.

In reviewing this prediction, the grade we gave ourselves is probably a bit unfair – it could be higher. But organizations still haven’t figured it out. They have hybrid experiences but they generally do a poor job of leveraging the afterglow of an event. It still tends to be “one and done,” then let’s move onto the next event or the next city and let the sales teams pick up the pieces.

So because of that, we’re only taking a B+ on this one.

Summarizing the review of our 2022 predictions: B+

Overall, if you average out the grades on the 10 predictions, they come out to a B+. We can’t seem to get that elusive A, but we’re going to try. Our friends at ETR and we are starting to look at the data for 2023 and put together our predictions. We’ve had hundreds of inbounds from PR pros pitching us. We have this huge thick folder that we’ve started to review with our yellow highlighter.

Our plan is to review the data this month. The ETR January survey is in the field and once we’ve digested that, we’ll come back and publish our predictions for 2023 in January.

So stay tuned for that. And if you have ideas or predictions of your own feel free to share with us. If we reference them, of course, we’ll give you attribution.

Keep in touch

Many thanks to Stu Miniman and David Floyer for their input to today’s episode. And of course to John Furrier for extracting the signal from the noise in his sitdown with Adam Selipsky. Kudos to Alex Myerson and Ken Shiffman on production, podcasts and media workflows for Breaking Analysis. Special thanks to Kristen Martin and Cheryl Knight who help us keep our community informed and get the word out, and to Rob Hof, our editor in chief at SiliconANGLE.

Remember we publish each week on Wikibon and SiliconANGLE. These episodes are all available as podcasts wherever you listen.

Email [email protected], DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at [email protected].

Here’s the full video analysis:

All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by SiliconANGLE Media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. You and only you are responsible for your investment decisions.

Disclosure: Many of the companies cited in Breaking Analysis are sponsors of theCUBE and/or clients of Wikibon. None of these firms or other companies have any editorial control over or advanced viewing of what’s published in Breaking Analysis.