It is part of a wider reining in of corporate titans and the booming tech sector by the Chinese government, set in motion by Ma’s criticisms, which has not only hit Alibaba but also its rivals. An estimated $1 trillion (£822bn) has been erased from their collective value.

Last week, Hangzhou-based Alibaba – which was founded in 1999 and brings in £110bn in annual revenue, serving 1.3 billion users globally – posted its first quarterly decline in growth since listing in New York in 2014. It reported revenue of 205bn yuan (£25.2m), narrowly beating analysts’ predictions, and halved profits.

The host of challenges facing Alibaba, including Covid and Beijing’s policies, has sent its share price to just 5pc above its listing price, from a peak of 249pc higher in late 2020.

“It has been a choppy few months for Alibaba, like two steps forward, one step back,” said David Waddell of Waddell & Associates in a note.

Meanwhile, Ma’s decision to step down will only further delay Ant Group’s plans to launch an initial public offering (IPO). Companies need to wait up to three years to list in mainland China after changes to their controlling shareholder, while Hong Kong requires a year-long hiatus.

Floating the tech company on the Hong Kong and Shanghai stock markets was supposed to have signified Chinese pragmatism meeting the western way of doing business, even as the US threatened to delist Chinese companies from its markets.

Angela Huyue Zhang, an associate law professor at the University of Hong Kong, told Channel News Asia when the listing was cancelled that Ma’s “scathing criticisms of Chinese financial regulation directly irked many senior officials who previously had voiced contrasting opinions on the same regulatory issues”. It was rumoured his remarks made it as far as president Xi.

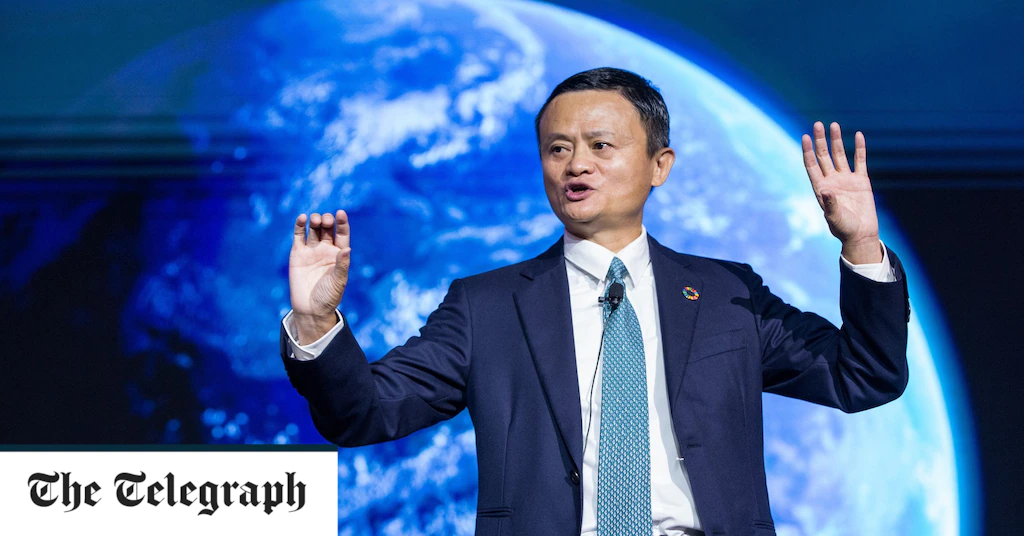

Perhaps the ideological divergence was no real surprise. The former English teacher has all the trappings of the capitalist executive’s lifestyle. He owns a superyacht, the Zen, and is reportedly worth in excess of $35bn (£28bn). Ma has even perfected the rags-to-riches story.

Yet however smart he may be, Ma’s public criticism of Beijing’s regulatory system was a step too far. Once outspoken, he has since kept a low profile – since vanishing and reappearing – as his business empire leaves his grasp.

Had China’s rulers kept themselves in check, perhaps China’s economy – which is suffering in the wake of Xi’s zero-Covid policy – would be enjoying a measure of greater prosperity.