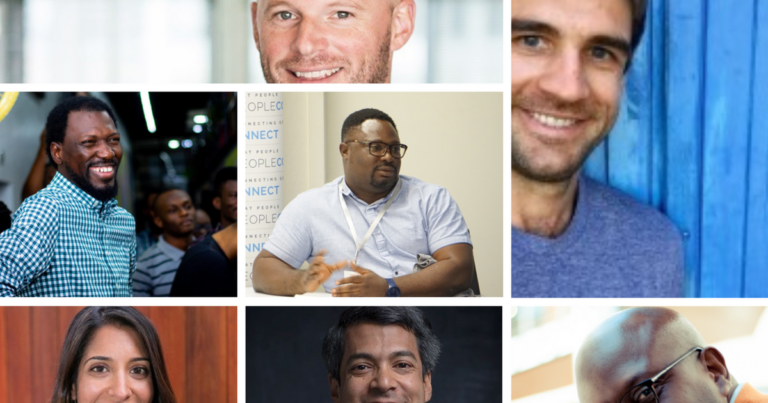

1. Drew Durbin

Drew Durbin is the founder and CEO of Wave Mobile Money, a money transfer service for individuals and businesses to send and receive funds globally. In 2021, Drew and team members raised $200 million in Series A equity funding at a valuation of $1.7 billion in 2021.

Drew Durbin is a Senegalese serial tech entrepreneur, and Wave is an affordable mobile money service changing the African narrative in the business world with financial inclusion. Drew told Billionaire Africa that Wave is a better, much more affordable mobile money service than telecommunications.

2. Olugbenga GB Agboola

After securing equity funding worth $170 million in Series C funding in 2021, Olugbenga GB Agboola’s Flutterwave is changing the payments landscape globally. According to Crunchbase, Flutterwave is a Nigerian financial technology company providing digital payments to global merchants. The company facilitates cross-border transactions and payments for small to large businesses globally.

Olugbenga GB Agboola is a co-founder and Chief Executive Officer of Flutterwave and has raised the company’s valuation to $3 billion. According to Tech Crunch, the high-valued African startup’s valuation increased after raising $250 million in a Series D round in 2022.

3. Samuel Ajiboyede

Samuel Ajiboyede is the CEO of Zido Global, a freight and distribution company reworking cargo transportation for transporters and shippers globally. Zido Global enhances cargo transportation efficiency with big data and a simplified logistics system. The private company is blazing a trail in the digital freight broker industry and changing the narrative for Africa.

Samuel Ajiboyede is a startup tech entrepreneur, established thought leader in finance, business strategist, and disruptive digital innovator. Zido Global raised $3 million to solve logistic frictions for businesses and individuals and signed a $10 million annual contract with one of Africa’s largest conglomerates in 2021.

4. Shivani Siroya

Shivani Siroya is Tala’s chief executive officer and founder, a financial technology startup helping the traditionally underbanked save and grow money. According to LinkedIn, Tala is a fin-tech company with a financial system that works for everyone. These emerging markets’ digital lenders with low-interest rates disburse loans to individuals without a formal credit history.

Shivani Siroya quit her investment banking job at the Silicon Valley Bank and founded Tala in 2011. The company raised $145 million for business expansion in 2021, and the app is a great way to get loans when you need them.

5. Andrew Watkins-Ball

The founder and chief executive officer of JUMO, Andrew Watkins-Ball, is a South African entrepreneur with a massive reputation in the business world. Andrew has 20 years of experience scaling businesses and arranging capital in Technology and Financial Services. According to Crunchbase, JUMO is one of the best market-leading banking-as-a-service platforms, enabling quick access to funds with low operating costs.

Andrew Watkins-Ball founded JUMO in 2015, and the company raised an impressive equity funding of $120 million from investors like Fidelity, Kingsway Capital, Visa, etc. JUMO is present in Rwanda, Uganda, Kenya, Tanzania, South Africa, and Ghana, and the company aims for global expansion with recent funding.

6. Tauriq Keraan

Tauriq Keraan is the chief executive office of TymeBank, South Africa’s first digital bank offering money transfer services and transactional accounts to customers. According to Tech Crunch, TymeBank increases financial access and usage for small businesses and individuals to encourage economic participation.

The company received its license from the South African Reserve Bank in 2017 and provided customers with educational apps and saving accounts.

Tauriq Keraan has an extreme passion for the finance and technology industry and established TymeBank in 2015. The company raised $109 million in 2021 and announced investments from investors, including CDC and Tencent.

7. Dare Okoudjou

Dare Okoudjou is the chief executive officer and founder of MFS Africa, a global financial technology startup streamlining the money transfer and payment industry. According to Tech Cabal, MFS Africa clarifies if a phone number can receive money from a regulatory point of view. The company can also define currencies the number can receive and applicable exchange rates.

Dare Okoudjou pursued an engineering and physics scholarship in Morocco before gaining startup experience in New York. MFS Africa raised $100 million through debt and equity and planned to make mobile money transfer as easy as making a phone call.

*The views expressed in this article are the views of a contributor at Business Insider Africa. It does not represent the views of the organisation Business Insider Africa.

Olayinka Sodiq is a qualified writer with technical, analytical and copywriting experience gained from 5 years of both in-house and freelancing gigs. He is versed in finance, investments, technology, blockchain, mergers & acquisitions, bankruptcy, etc.