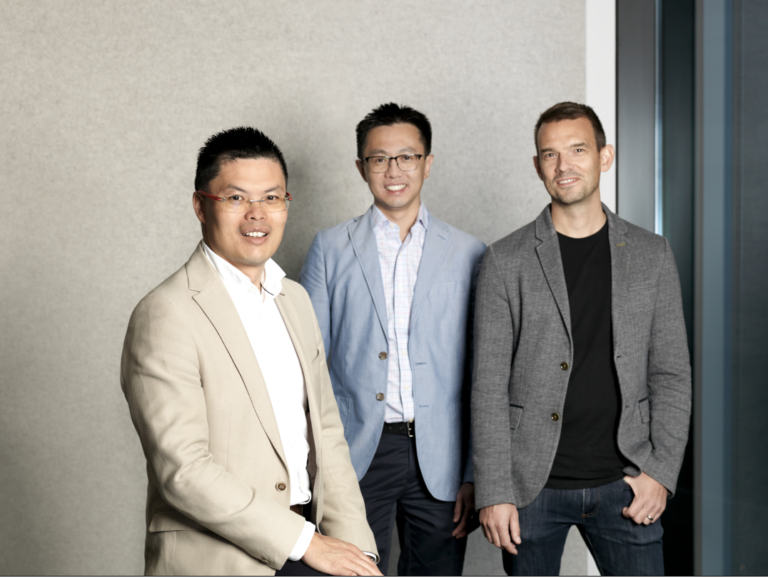

mx51, a payments technology company founded by Victor Zheng, Magnus Hsu and Steve Hadley has raised $32.5 million in a Series B round.

The round was led by an undisclosed global fintech investor and tops up the cash already invested by companies such as Mastercard, Acorn Capital, Commencer Capital, Rampersand and Artesian.

Since closing its $25 million Series A round last year, which occurred within 12 months of launch, the company has doubled its global headcount to over 100, and now says it is on track to more than double revenues this calendar year.

Payments offer a huge contestable market worldwide. Just cross-border e-commerce transactions alone are going to surpass the $2 trillion mark for the first time in 2023, according to Juniper Research.

mx51’s product serves two distinct markets, banks and acquirers, mx51’s payments-as-a-service platform provides a futureproofed payments solution, that effectively leverages their existing legacy technology infrastructure.

For merchants, mx51 provides a suite of embedded payment solutions to create a seamless experience, both online and in-store. The platform is regularly updated with new modules and capabilities, which when coupled with robust self-service features and deep customer insights, allow banks and acquirers to consistently deliver a best-in-class experience for merchants.

According to mx51 CEO and co-founder, Victor Zheng said, “Thanks to our partnerships to date, we estimate we now have the means to access a significant share of Australia’s merchant market. With this new capital, we’re poised for an aggressive rollout over the next few years, first in Australia and then abroad.”

The funds will be used both the expand the reach of the company and also to further invest in its core in-store, online payments and merchant dashboard solutions, according to a statement accompanying the news of the capital raising. It also plans to develop further capabilities to assist with fraud prevention and data-driven customer insights.

“We’ve succeeded on the back of our sharp focus on simplifying the merchant payment experience, and empowering banks and acquirers to innovate around legacy technology and to keep pace with changes in the payments sector,” Zheng said.

“This capital raise is also in spite of global macro headwinds. This is because our primary customers, banks and acquirers, are well positioned to deepen collaboration and co-invest with fintechs to deliver modern payment experiences to their merchants.”

Early investors say they are bullish about the company’s prospects.

Paul Naphtali, managing partner, Rampersand, who has backed mx51 since pre-seed said, “Mega rounds in this market cycle may well be rare, but mx51 is a rare case. The tenacity and daring to build bank-grade core infrastructure with relatively little funding shows how the Australian founder mindset is critical – build more with less. This has the potential to be another Australian-made global fintech success story.”

Robert Routley, Acorn Capital CEO, meanwhile, said, “mx51’s payments technology has a compelling value proposition that has been validated by a rate of customer adoption that has exceeded our expectations since our initial investment in 2021. The current funding round positions the Company well to execute on its global expansion strategy.”